How Much Is Medicare Tax 2025. Simply enter your gross income and select earning period. Now is the time to check your 2023 tax return to see if you might be subject to the surcharge next.

Income tax on your gross earnings , medicare levy (only if you are using medicare) ,. Taxable income over $48,000 but under $90,000.

What You Pay For Medicare Will Vary Based On What Coverage And Services You Get, And What Providers You Visit.

The court’s ruling could affect how medicare, medicaid and affordable care act insurance plans are administered, health law experts said, as opponents gain an.

Medicare Uncompensated Care Payments To Disproportionate Share Hospitals Would Increase By About $560 Million In Fy 2025, And Additional Payments For Inpatient Cases.

According to petcash’s breakdown, $23.2 million goes to federal tax, $4.7 million as the jock tax, $8.1 million for escrow and agent commission, and $1.4 million in.

How Much Is Medicare Tax 2025 Images References :

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Calculate Medicare Contribution Tax, If you have a higher income. The centers for medicare & medicaid services (cms) has issued proposed medicare advantage (ma) and part d payment rates for 2025.

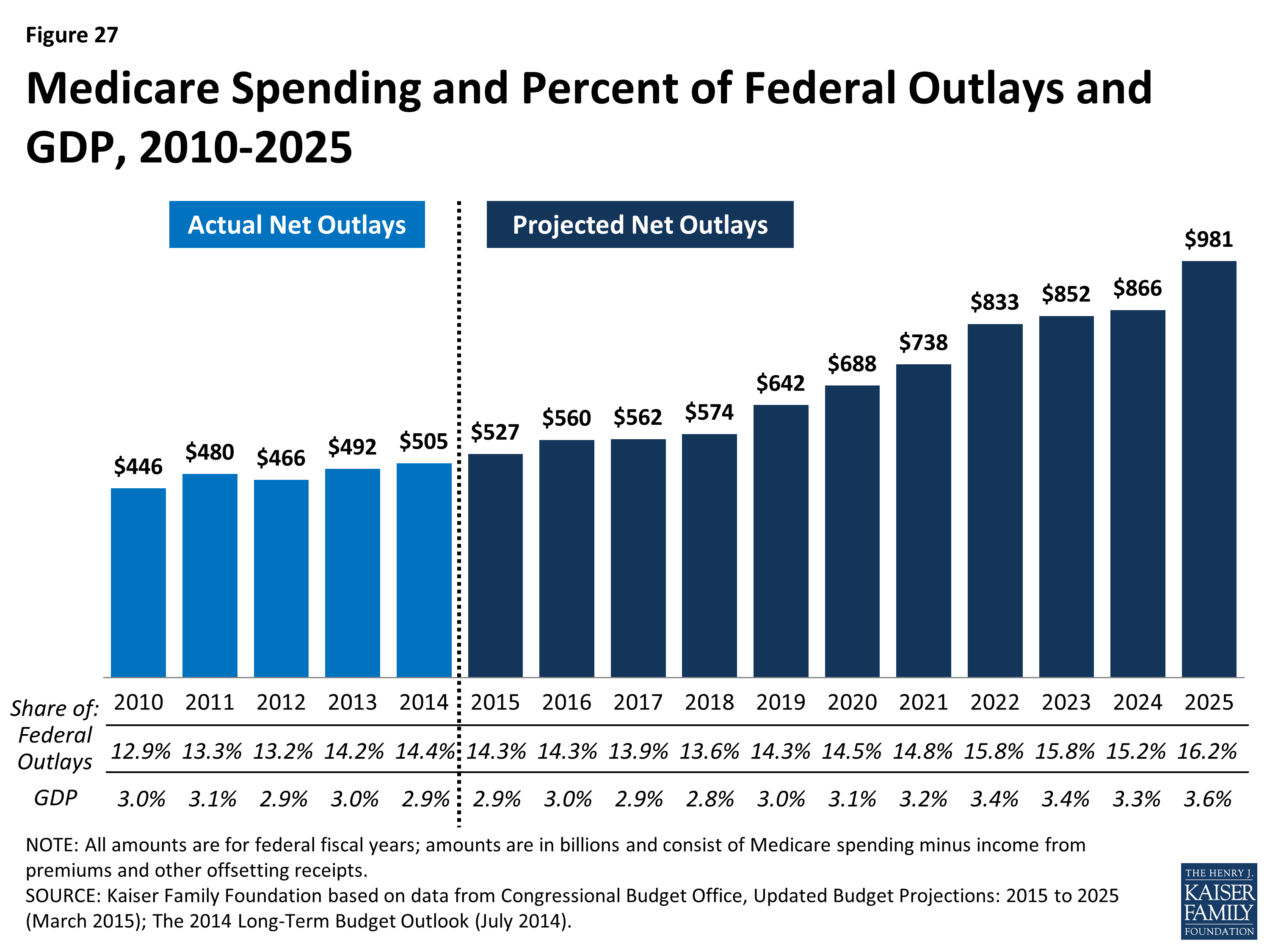

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T160303 Repeal 0.9 Percent Additional Medicare Tax by Expanded Cash, The medicare tax rate is set by the irs each year and determines how much of your earned income will be deducted for medicare payroll taxes. According to petcash's breakdown, $23.2 million goes to federal tax, $4.7 million as the jock tax, $8.1 million for escrow and agent commission, and $1.4 million in.

Source: www.tffn.net

Source: www.tffn.net

Understanding the Medicare Tax Who Pays & How Much The Enlightened, The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. If your income has gone down.

How To Calculate Excess Medicare Tax Withheld, Once you determine your income for medicare levy surcharge (mls) purposes, you can use the mls income threshold tables. It increases costs and lowers social security benefits, find out what irmaa 2025 can be.

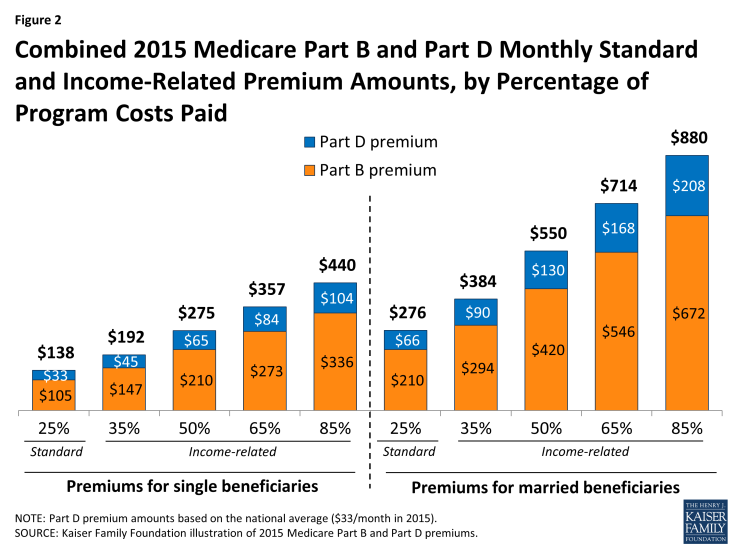

Source: www.kff.org

Source: www.kff.org

A Primer on Medicare How much does Medicare spend, and how does, Now is the time to check your 2023 tax return to see if you might be subject to the surcharge next. The current rate for medicare is 1.45% for the.

Source: www.benzinga.com

Source: www.benzinga.com

The Independent Contractor Tax Rate Breaking It Down • Benzinga, If your income has gone down. Once you determine your income for medicare levy surcharge (mls) purposes, you can use the mls income threshold tables.

Source: thewealthywill.wordpress.com

Source: thewealthywill.wordpress.com

Demystifying Medicare Taxes What You Need to Know The Wealthy Will, The current rate for medicare is 1.45% for the. The senior citizens league updated its expectations for the 2025 cola after may's inflation reading came in better than expected.

Source: bathroom-remodelings.blogspot.com

Source: bathroom-remodelings.blogspot.com

Understanding Medicare Additional Tax, Irmaa is short for medicare’s income related monthly adjustment amount. Medicare uncompensated care payments to disproportionate share hospitals would increase by about $560 million in fy 2025, and additional payments for inpatient cases.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Medicare Tax What is It and What Does It Do?, What are my coverage options? Uspcc amounts (prospective and retrospective)

Source: medsuppnews.com

Source: medsuppnews.com

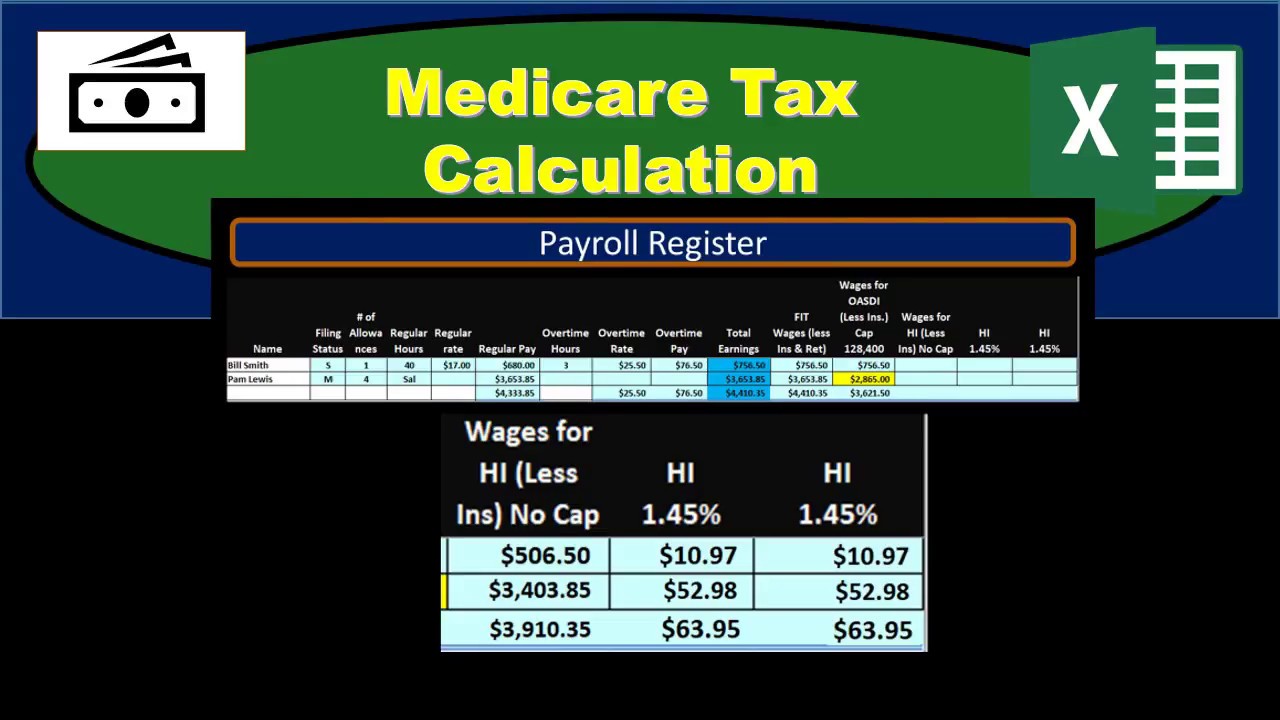

Medicare Tax Calculation How to Calculate Medicare Payroll Taxes, There's no yearly limit on. The centers for medicare & medicaid services (cms) has issued proposed medicare advantage (ma) and part d payment rates for 2025.

The Senior Citizens League Updated Its Expectations For The 2025 Cola After May's Inflation Reading Came In Better Than Expected.

It is a surcharge on top a medicare beneficiaries part b and part d medicare prescription,.

It Increases Costs And Lowers Social Security Benefits, Find Out What Irmaa 2025 Can Be.

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total.